Mastering Personal Finances

Software

SoftwareIf your budget feels like it’s running you instead of the other way around, it’s time to switch things up. Rocket Money puts you in control—track spending, cancel unused subscriptions, and set savings goals all in one place. Take charge of your money—get started with Rocket Money now.

Meet Rocket Money: Your Wallet’s New Best Friend

Tired of losing track of where your money goes? Rocket Money steps in like a personal finance sidekick—automatically tracking your spending, flagging sneaky subscriptions, and helping you cancel the ones you don’t need. It even helps you set budgets, save smarter, and negotiate bills, all from one sleek, easy-to-use app.

But Rocket Money doesn’t stop at budgeting—it keeps an eye on your credit score, sends you real-time alerts, and offers smart insights tailored to your habits. It’s not just about cutting costs; it’s about making every dollar work harder for you.

Ready to take control? Download Rocket Money and start managing your money with ease and confidence.

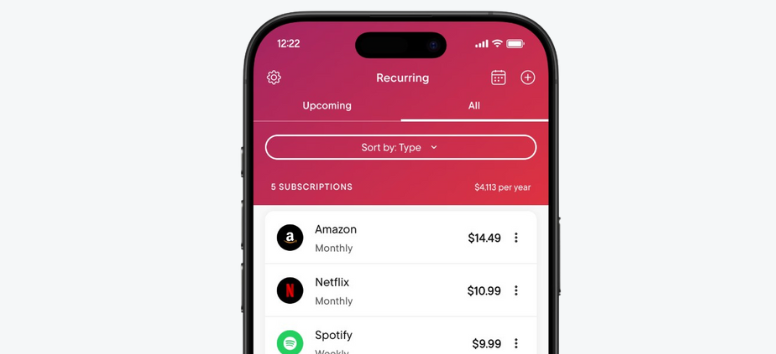

Manage Subscriptions with Ease

Rocket Money helps users take control of their subscriptions by identifying recurring charges across all accounts. From long-forgotten trials to rarely used streaming services, the app highlights what’s draining funds—and offers a built-in concierge to cancel unwanted subscriptions on behalf of the user.

Serving as a central hub for subscription management, Rocket Money presents everything in one easy-to-read list, so users never lose track of what they’re paying for. It also sends reminders for upcoming bills and provides a recurring payments view that members rely on to avoid missed due dates, overdraft fees, and surprise charges.

With nearly 2.5 million subscriptions canceled for its members, Rocket Money continues to save time, money, and stress. Start using Rocket Money today and simplify the way you manage subscriptions.

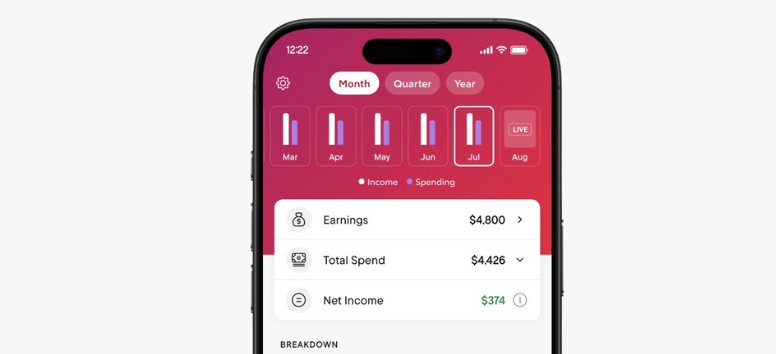

Spending Insights That Make Sense

Rocket Money gives users a clear, effortless breakdown of their finances, helping them stay on top of their spending with real-time insights and personalized alerts. By connecting directly to bank accounts, the app quickly identifies top spending categories, offering a smart snapshot of where the money goes—and where it shouldn’t.

With spending insights tailored to individual habits, users can easily spot areas to cut back, boost savings, and plan ahead with confidence. Rocket Money also sends real-time alerts for upcoming charges, low balances, and unexpected activity, helping users avoid overdrafts and late fees before they happen.

Ready to get smarter about your spending? Download Rocket Money and turn your data into financial progress.

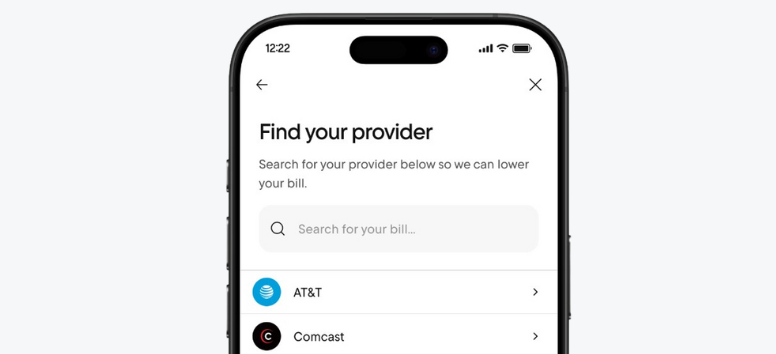

Bill Negotiation Made Simple

Rocket Money takes the stress out of lowering bills by doing the hard work for its users. The app automatically scans connected accounts to find savings opportunities, then assigns expert negotiators to work directly with service providers—aiming to secure the best possible rates on everything from cell phone to cable bills.

Users can also rely on Rocket Money to help with overdraft and late fee refunds, offering easy-to-follow steps when surprise charges appear. For those seeking better car insurance rates, the process is just as effortless—simply connect an existing policy, and Rocket Money will present personalized options without endless forms or guesswork.

Start saving without lifting a finger—let Rocket Money negotiate your bills today.

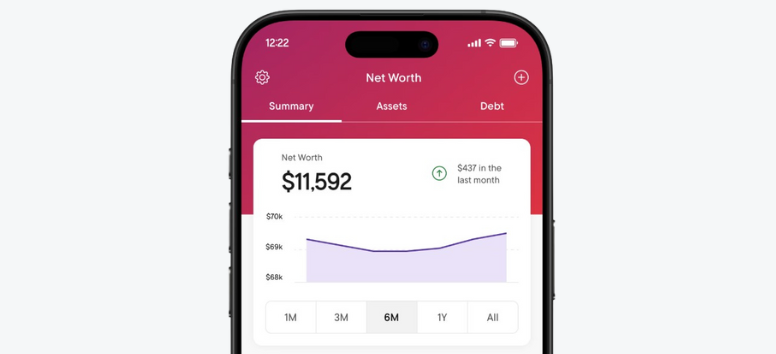

Track and Grow Your Net Worth

Rocket Money provides users with a comprehensive view of their finances through its Net Worth feature, which tracks everything they own and owe in a single, easy-to-navigate dashboard. By linking all accounts or adding custom categories, users can see their full financial picture and monitor their progress over time.

From traditional assets like 401(k)s to unique items like collectibles, anything can be added to reflect true value. Rocket Money automatically updates asset values and debt balances, eliminating the need to jump between multiple accounts. It's a simple, powerful way to measure financial health and build long-term wealth.

Take control of your financial future with Rocket Money’s Net Worth tool.

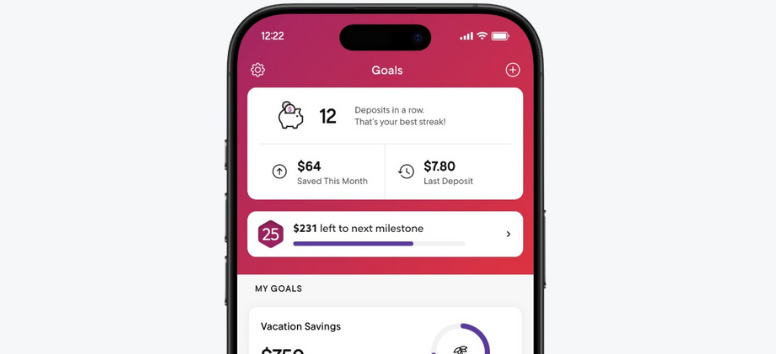

Financial Goals Made Automatic

Rocket Money’s Financial Goals feature takes the guesswork out of saving by putting the process on autopilot. It analyzes each user’s spending patterns to determine the best time to move money into savings—helping them reach their goals faster while avoiding overdraft fees.

Setting up a goal is simple: choose a target, pick how often to save, and watch the balance grow. Deposits are securely held in an FDIC-insured account through Rocket Money’s trusted banking partner. And because users stay in full control, they can adjust their savings anytime to fit their needs.

Make consistent saving a habit with Rocket Money’s Financial Goals.

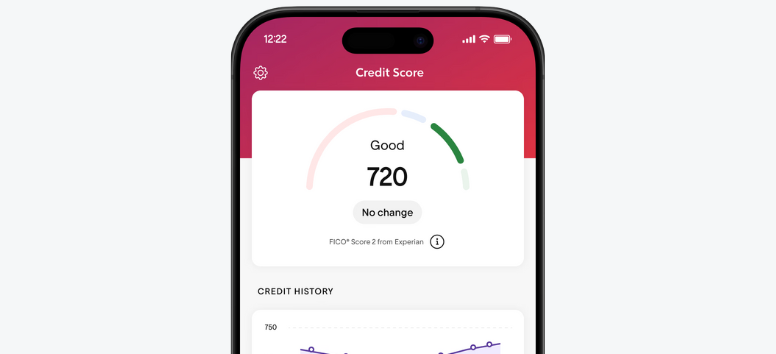

Track and Understand Your Credit Score

A credit score affects more than just loan approvals—it can influence interest rates, rental applications, and even car insurance premiums. With Rocket Money, users get full access to their credit report and history, along with real-time alerts and clear explanations of what’s impacting their score.

The platform breaks down the key factors behind a credit score, such as payment history, credit utilization, and account age. It also tracks changes as they happen, helping users stay informed and prepared before applying for new credit.

Stay ahead of the game—monitor your credit health with Rocket Money.

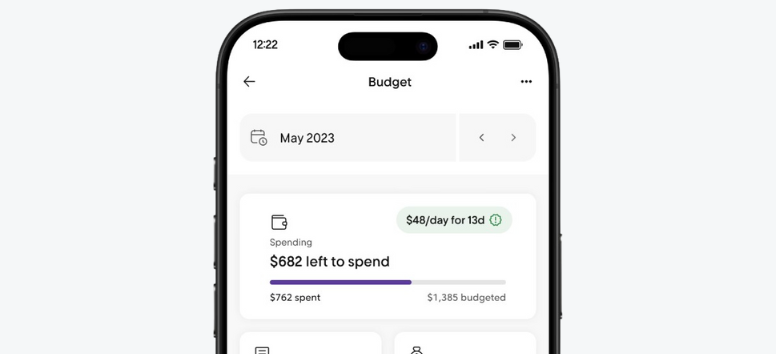

Create a Budget That Works for You

Rocket Money makes budgeting simple and personalized by automatically tracking spending across categories. It helps users set realistic goals and stick to them, offering smart insights and alerts that guide everyday decisions and long-term financial planning.

The app analyzes spending habits to calculate a monthly allowance, making it easy to know how much is available to spend. Users can create goal trackers for specific categories and get notified when they’re nearing their limits—helping them stay disciplined without guesswork.

Take control of your monthly spending with Rocket Money’s powerful budgeting tools.

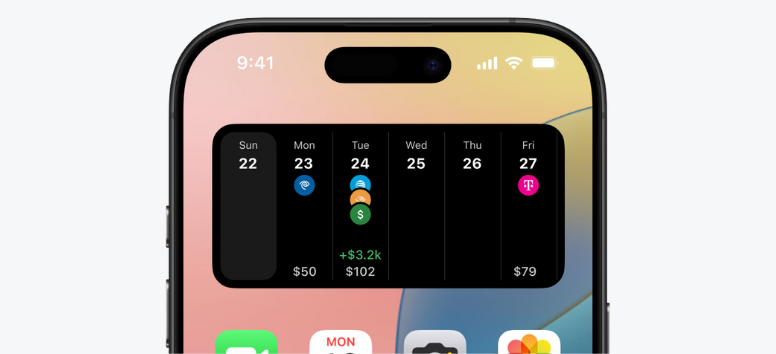

Stay on Top of Your Finances with Widgets

Rocket Money Premium members on iOS can now access exclusive widgets that bring real-time financial updates right to their home screen. These tools provide a quick, at-a-glance view of what matters most—so users stay informed without opening the app.

From tracking upcoming bills and paydays to reviewing recent transactions, everything is visible with one tap. Users can even check how much is safe to spend before their next paycheck, helping them make smarter choices throughout the week.

Keep your finances front and center with Rocket Money’s iOS widgets.

Get More from Your Finances with Rocket Money Premium

Rocket Money Premium offers more than just upgraded features—it provides real human support to help users cancel unwanted subscriptions, negotiate bills, and get personalized assistance with financial questions. It’s a smarter way to manage money with tools and guidance that go beyond the basics.

With the free plan, users can:

-

Link checking, savings, credit cards, and investment accounts

-

Receive balance alerts for low funds or high credit usage

-

Automatically detect subscriptions and recurring bills

-

Track spending trends with all accounts in one view

With Premium, users unlock everything in the free plan, plus:

-

A subscription cancellation assistant to handle cancellations on their behalf

-

An automated savings plan tailored to their goals

-

Additional features like net worth tracking, shared accounts, unlimited budgets, and more

Upgrade to Premium and let Rocket Money do more of the work—so you can focus on reaching your financial goals.

Financial peace of mind is within reach, and Rocket Money is built to help you get there. Its features are simple to use, yet powerful enough to guide real change in how you handle your money. From tracking spending to canceling unused subscriptions, every tool works together to support your financial well-being. It’s like having a financial assistant in your pocket. Discover what Rocket Money can do for you and take the next step toward confident money management.