How Smava Compares Loan Options

Services

ServicesSmava is one of Germany’s leading online platforms for comparing personal loans, built to simplify a process that often feels opaque. By bringing together loan offers from more than 20 banks, Smava allows borrowers to review interest rates, terms, and monthly payments in one place. The platform focuses on transparency and fairness, helping users identify loan options that fit their budget and financial goals without unnecessary complexity or hidden trade-offs.

How Smava’s Loan Comparison Process Works

Smava simplifies loan comparison by bringing offers from more than 20 partner banks into one clear, SCHUFA-neutral search. Instead of jumping between lenders or guessing which rate applies to you, borrowers see personalized options in minutes through a fully digital process. Every step is built around transparency, helping users quickly spot the most affordable financing and choose a loan that makes financial sense without unnecessary back-and-forth.

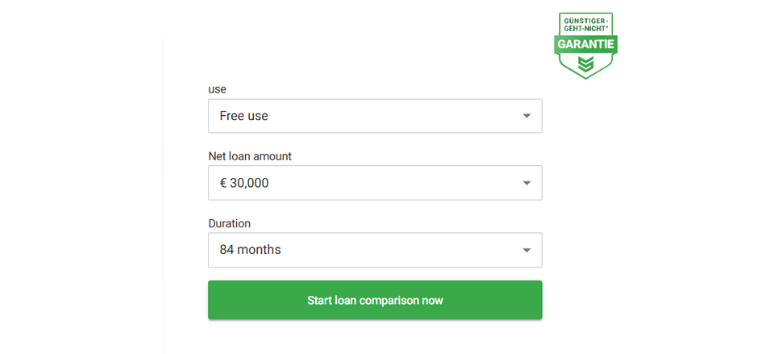

User Inputs & Loan Requirements

To start a comparison, borrowers enter a small set of details that allow Smava to match them with relevant loan offers. These inputs form the foundation of the comparison and determine which partner banks and interest rates are shown.

Desired Loan Amount

Borrowers can request a net loan amount ranging from €1,000 to €150,000. This wide range makes the platform suitable for both smaller financing needs and larger planned expenses. According to Smava’s loan app listing, the stated range is “Net loan amount: from €1,000 to €150,000,” ensuring flexibility for different borrower profiles.

Loan Term

Loan terms can be selected from 6 to 120 months. This allows users to balance monthly affordability with total repayment cost. Smava confirms this range in its app as “Runtime: Min. 6 to Max. 120 months,” giving borrowers control over how long they want to repay.

Purpose of the Loan (Optional)

Borrowers may optionally select a purpose such as car financing, debt consolidation, home improvement, or personal expenses. While not mandatory, this information can improve matching accuracy, as some banks offer more favorable rates for specific loan purposes.

Additional Requirements

Borrowers must be at least 18 years old, have a German address, and show regular income such as a salary or a pension. These criteria determine which banks can legally and financially extend an offer.

Compare loan options on Smava to see which offers match your needs and repayment goals.

SCHUFA-Neutral Pre-Check

One of the most important features of Smava is its SCHUFA-neutral credit inquiry, which allows borrowers to compare loan offers without putting their credit profile at risk.

How It Works

Smava uses a soft credit check to assess basic eligibility before displaying loan offers. This type of inquiry gives partner banks enough information to calculate potential rates and terms, but it does not register as a full credit request with SCHUFA.

As a result, the borrower’s credit score remains unchanged throughout the comparison process. Smava highlights this clearly in its Google Play listing, stating: “Find the best loan offers… 100% free and SCHUFA-neutral!”

Why It Matters

A SCHUFA-neutral pre-check allows borrowers to compare offers safely and confidently. There is no negative impact on creditworthiness, even if multiple comparisons are made. Users can also adjust loan amounts or repayment terms to see how different scenarios affect pricing, all without penalty. This makes it easier to explore options and make informed decisions before submitting a formal loan application.

Check loan offers on Smava without affecting your SCHUFA score and compare with confidence.

Automated Comparison Engine

After a borrower submits their details, Smava activates its automated comparison engine to retrieve and evaluate loan offers from its partner banks. This system processes multiple offers at once, allowing borrowers to review structured results without manual outreach or negotiations.

Partner Bank Network

Smava compares personal loan offers from more than 20 banks in Germany. These include large, well-known financial institutions as well as specialized lenders that focus on specific borrower profiles or loan purposes. This broad network increases the likelihood of finding competitive rates across different financial situations.

Criteria Used in Comparison

Effective Annual Interest Rate (APR)

APR reflects the true cost of borrowing, including interest and mandatory fees. Smava displays APR ranges from –0.40% up to 19.90%, depending on credit profile, loan amount, and term.

Monthly Installment

Monthly payments are calculated automatically based on the selected loan amount, repayment term, and APR. Smava’s calculator updates these figures in real time.

Total Repayment Amount

The comparison tool shows the full repayment total, including principal, interest, and any applicable fees, in a transparent format.

Special Conditions

Smava highlights options such as early repayment, payment breaks, fixed or variable interest, and promotional rates to help borrowers assess flexibility.

Use Smava’s comparison engine to review loan offers side by side and choose the option that fits your financial plan.

Presentation of Loan Options

Once borrower data is processed, Smava presents results in a clear, ranked list designed to make comparison straightforward. Instead of forcing users to decode dense tables, the platform organizes offers so that key differences are easy to spot at a glance.

Ranked List of Offers

Loan offers are sorted using several practical criteria. These include the lowest APR, approval likelihood, and overall affordability, while also factoring in user preferences such as loan purpose and repayment term. This ranking helps borrowers focus on options that are not only competitive but also realistic for their profile.

Transparent Breakdown of Each Offer

Each offer includes a detailed cost overview. Interest rates may be shown as low as 0.68% APR, with some promotional loans displaying negative APR values (–0.40%) for eligible borrowers. Any processing or service fees are clearly listed, and many partner banks offer fee-free loans. Borrowers can also review the total repayment amount, total interest paid, and a full monthly installment schedule. Smava’s calculator provides concrete examples, such as a €20,000 loan over 84 months at 5.39% APR.

“Best Match” Highlight

Smava highlights the option that best aligns with credit profile, budget, loan purpose, and approval probability, helping users decide faster.

Review your ranked loan offers on Smava and choose the option that fits your financial plan with clarity.

What Makes Smava a Go-To Platform for Loan Comparisons

Smava combines clear pricing, verified data, and a fully automated process that removes friction from borrowing decisions. Instead of relying on marketing claims, Smava builds trust through transparency and measurable outcomes. The features below highlight the specific reasons borrowers consistently turn to the platform when comparing loan options.

Wide Network of Banks

A core strength of Smava is the breadth of its partner bank network, which gives borrowers access to significantly more loan options than a single lender can offer. Instead of limiting users to one institution’s criteria, Smava opens the door to a diverse range of financing sources within a single comparison.

How Smava Expands Your Options

Smava compares personal loan offers from more than 20 partner banks operating in Germany. These partners include established national banks, digital-first lenders, and specialized credit providers that focus on specific borrower profiles or loan purposes. This diversity allows the platform to present offers across a wide spectrum of interest rates, approval conditions, and repayment structures.

A broader lender network directly improves outcomes for borrowers. It increases approval chances, particularly for applicants with non-standard profiles such as freelancers, self-employed individuals, or borrowers seeking higher loan amounts. At the same time, competition among banks pushes lenders to present more attractive interest rates and conditions in order to stand out.

What This Means for Borrowers

Instead of submitting separate applications to multiple banks, borrowers receive several offers instantly through one comparison. This saves time, reduces effort, and improves the likelihood of securing a loan that meets both budget and eligibility requirements.

Compare offers from multiple banks on Smava and find a loan option that works for your situation.

Guaranteed Low Rates (“Günstiger-Geht-Nicht-Garantie”)

One of the strongest differentiators of Smava is its focus on consistently competitive pricing. The platform is built around low-interest loan access, reinforced by its Günstiger-Geht-Nicht-Garantie, or best-rate guarantee, which aims to surface the most affordable option available for each borrower profile.

How the Rate Guarantee Works

Smava advertises interest rates ranging from –0.40% up to 19.90% APR, as stated in its app listing. Rates vary based on credit profile, loan amount, and repayment term, but the platform’s comparison engine is designed to identify the lowest eligible rate across its partner banks. The best-rate guarantee reflects this structure, where multiple lenders compete simultaneously to offer more attractive pricing.

By ranking offers based on cost efficiency, Smava reduces the chance that borrowers overlook cheaper alternatives that might exist outside a single bank’s portfolio.

What This Means for Borrowers

Borrowers can compare loan options knowing the system prioritizes affordability. Instead of accepting a rate from one institution, users see how their profile performs across the broader market, helping them secure financing at the lowest available cost.

Explore Smava’s current loan rates and see how the best-rate guarantee works in your favor.

Significant Cost Savings

Reducing the overall cost of borrowing is one of the clearest advantages of using Smava. By combining digital efficiency with lender competition, the platform consistently surfaces loan options that undercut typical market pricing.

How Smava Delivers Lower Borrowing Costs

Borrowers using Smava pay more than 35% less on average compared to Germany’s national loan averages. These savings are driven by Smava’s fully digital comparison model, which removes many of the overhead costs associated with traditional branch-based lending. At the same time, Smava’s broad partner bank network creates direct competition, encouraging lenders to offer more aggressive rates to win borrower profiles.

Instead of accepting a single bank’s standard pricing, users see how their profile performs across multiple institutions at once. This market-wide comparison is what allows lower-cost offers to rise to the top, especially for borrowers with stable income and clear repayment plans.

What This Means for Borrowers

Lower interest rates have a direct and practical impact. Monthly installments become more manageable, total repayment amounts decrease, and long-term financial strain is reduced. These benefits are especially relevant for debt consolidation and large planned purchases, where even small rate differences can add up to significant savings over time.

Compare loan offers on Smava and see how much you could save compared to average market rates.

Fully Digital Application Process

A defining feature of Smava is its end-to-end digital application flow, which removes many of the delays traditionally associated with borrowing. From the initial comparison to final approval, the entire journey is designed to work online, without unnecessary steps or physical paperwork.

How the Digital Process Works

Smava allows borrowers to complete their loan application entirely online, including document submission and contract signing. According to Smava’s technical documentation and app descriptions, the process is built to be fast, digitalized, and efficient. Secure document uploads enable users to submit income proof and identification directly through the platform, while automated verification tools help partner banks review applications more quickly. This streamlined setup reduces manual checks and shortens processing times across the board.

By centralizing these steps in one digital workflow, Smava minimizes friction that often slows down traditional loan applications, such as repeated form submissions or in-person appointments.

What This Means for Borrowers

A fully digital process translates into faster approvals, fewer delays, and no need for branch visits. Borrowers deal with less paperwork and gain a smoother overall experience. This approach is especially valuable for busy professionals or anyone who needs access to funds without waiting days or weeks for manual processing.

Apply for a loan online through Smava and experience a faster, more convenient way to secure financing.

Smava brings clarity to loan shopping by combining transparent, data-driven comparisons with access to multiple banks in one place. Instead of navigating fragmented offers or relying on a single lender, borrowers can review competitive rates, clear repayment terms, and eligibility details in a structured format.

With SCHUFA-neutral pre-checks, a broad lender network, consistently low rates, and a fully digital application process, Smava removes much of the friction from borrowing decisions. Try Smava today to compare loan options side by side and see which offers fit your financial goals.